The United States Federal Reserve’s Federal Open Market Committee (FOMC), after its two-day policy meeting, decided to keep key interest steady in the range of 3.50% to 3.75%, according to the official statement released on Wednesday, 28 January 2025.

The steady rates come after the central bank cut benchmark rates three times in a row. The US central bank has lowered its benchmark interest rates starting from September 2025. The Federal Reserve has cut a total of 75 basis points in 2025, after it kept the interest rates unchanged from December 2024.

5 key highlights from US Fed’s policy decision

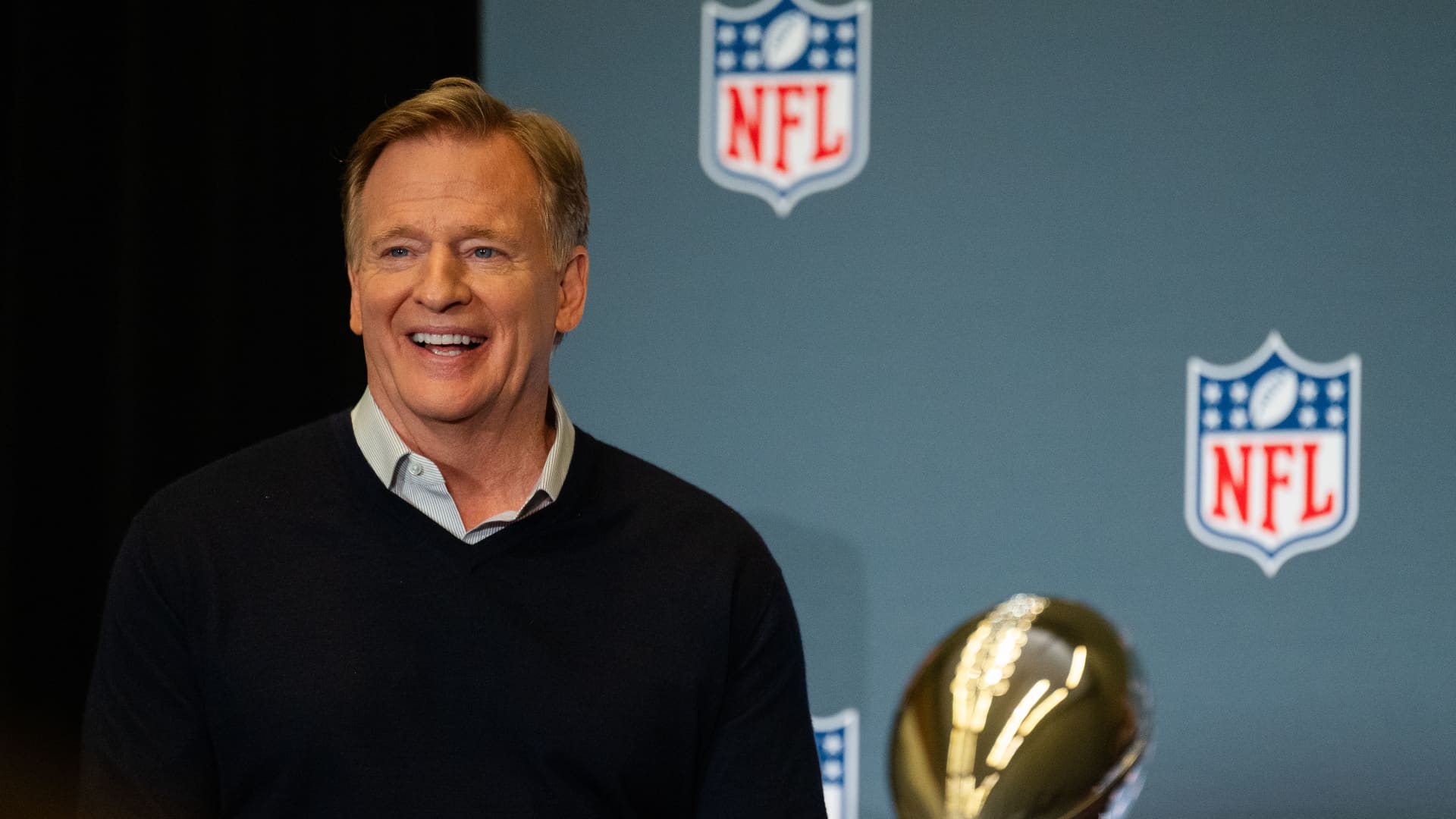

Here are five key highlights from the US Federal Reserve’s policy decision and Chairman Jerome Powell’s speech from 28 January 2026 —

1- FOMC holds interest rates

Federal Reserve Chairman Jerome Powell-led FOMC kept the key benchmark interest rates steady in the range of 3.50% to 3.75% as it plans to carefully assess incoming data, the evolving outlook, and the balance of risks.

10 of the 12 members voted in favour of the Fed’s policy decision to cut interest rates, while two, Stephen Miran and Christopher Waller, voted for a 25-basis-point rate cut.

“In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 3-1/2 to 3-3/4 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” the FOMC statement read.

2- FOMC on inflation

Powell said that core inflation likely hit 3% in December but remains on track to return to the Federal Reserve’s 2% target. He added that the personal consumption expenditures (PCE) price index showed continued goods inflation, though services inflation eased towards the end of the year.

3- Will Fed cut rates soon?

Responding to the question of the next rate cut, Powell said that, following recent rate cuts, the Federal Reserve aims to manage risks effectively and make decisions based on data.

“Haven’t made any decisions about future meetings. But you know the economy is growing at a solid pace, the unemployment rate has been broadly stable, and inflation remains somewhat elevated, so we’ll be looking to our goal,” Powell said.

4 – Tariffs pushing up prices

According to Powell, most of the increase in goods prices is due to tariffs, which is preferable as it indicates less demand-driven inflation. Tariffs are expected to be a one-time issue, leading to core PCE inflation running just above 2% without their impact.

“The overrun in goods prices is from tariffs. And that’s actually good, because if it weren’t from tariffs, it might mean it’s from demand, and you know, that’s a harder problem to solve. We do think tariffs are likely to move through and be a one-time price, so most of the overshoot, core PCE, inflation is running just a bit above 2% x the effects of tariffs on goods,” Powell said.

5 – Job growth slows

According to Powell, job growth has slowed in the past year due to a decline in labour force growth driven by lower immigration and participation rates. Labour demand has softened, with little change in job openings, layoffs, hiring, and nominal wage growth in recent months.

Disclaimer: This story is for educational purposes only. The views and recommendations expressed are those of individual analysts or broking firms, not Mint. We advise investors to consult with certified experts before making any investment decisions, as market conditions can change rapidly and circumstances may vary.