At the heart of the Bill is a shift away from the monopoly-based distribution model towards regulated competition. The framework would allow multiple licensees to operate in the same geography using shared network infrastructure, with the aim of improving efficiency, financial sustainability and consumer choice.

The reform push comes against the backdrop of persistent stress in the distribution segment, marked by high aggregate technical and commercial losses, weak billing efficiency and tariff distortions that continue to weigh on state-run utilities. Under the proposed framework, State Electricity Regulatory Commissions would be tasked with enforcing cost-reflective tariffs and uniform wheeling charges, broadly mirroring the competitive transmission model that has helped improve efficiency in power transmission.

Against this backdrop, here are a few power sector stocks that investors are closely tracking.

Tata Power

Part of the Tata GroupTata Power is among India’s largest integrated power companies and a key player across generation, transmission and distribution. Its transmission and distribution business is the company’s largest revenue contributor, accounting for roughly three-fifths of consolidated revenue in FY25.

The company serves millions of consumers across major urban centres such as Delhi and Mumbai, supported by advanced smart grid and digital distribution infrastructure. Alongside this, it maintains a diversified presence in conventional power generation and renewables.

Given that the Electricity Amendment Bill directly targets reforms in power distribution, Tata Power’s scale and operational depth in this segment place it firmly on investors’ radar. That said, the pace and ultimate impact of the reforms will depend on state-level cooperation and clarity around cost-sharing and implementation mechanisms.

Financially, Tata Power has delivered steady growth over the past three years, with revenue and profit expanding at a healthy pace and returns remaining stable.

Looking ahead, the company has indicated that it plans to strengthen its transmission portfolio by securing additional projects through tariff-based competitive bidding, while also expanding its distribution footprint as new opportunities emerge.

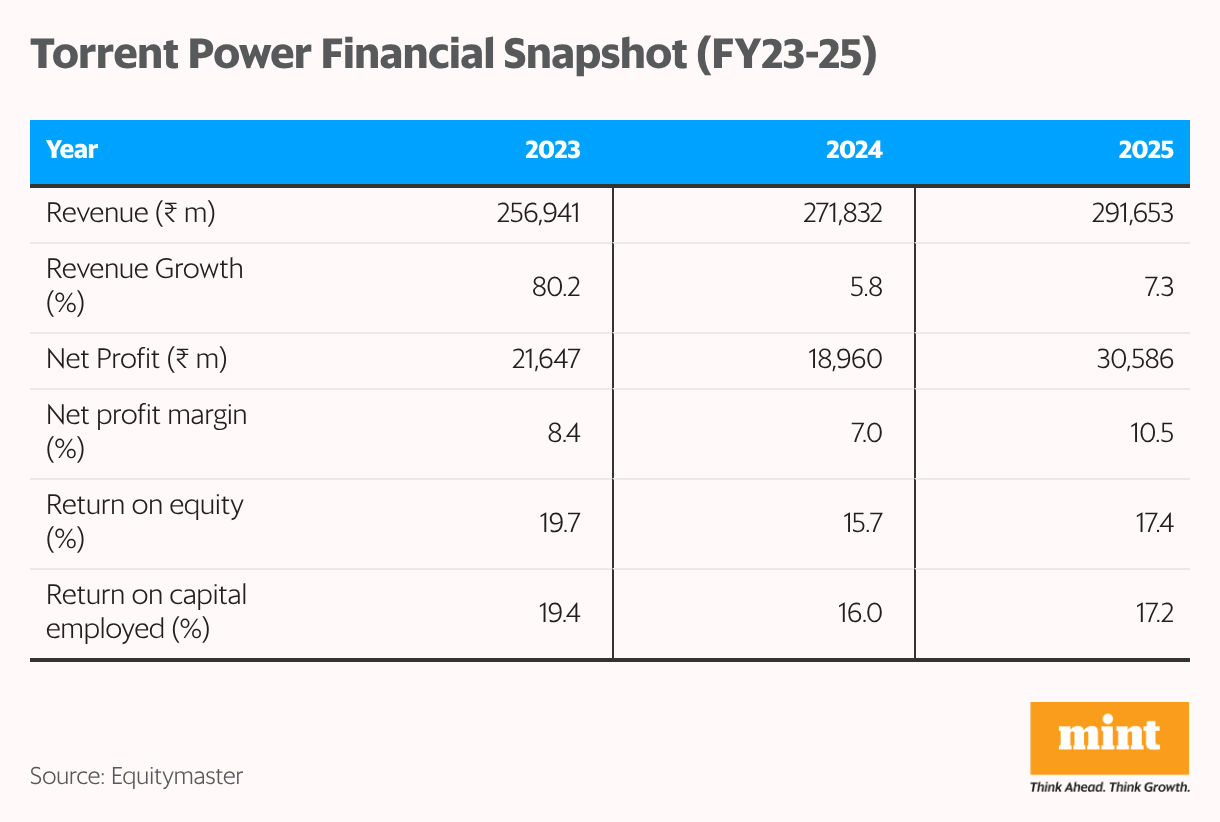

Torrent Power

Torrent Power is one of the most established private-sector players in India’s power sector, with a long operating history across generation, transmission and distribution. The company’s business is heavily skewed towards transmission and distribution, which accounts for the overwhelming majority of its turnover.

This concentration makes Torrent Power particularly sensitive to the proposed changes under the Electricity Amendment Bill. Any move towards regulated competition, cost-reflective tariffs or shared network infrastructure could have a direct bearing on its core business performance.

Over the past three years, the company has posted strong growth in both revenue and profitability, supported by improving margins and robust returns on capital.

Going forward, Torrent Power has outlined plans to expand its distribution business by pursuing opportunities arising from distribution privatisation, parallel licensing and franchisee models—areas that could see renewed momentum if the proposed reforms move ahead.

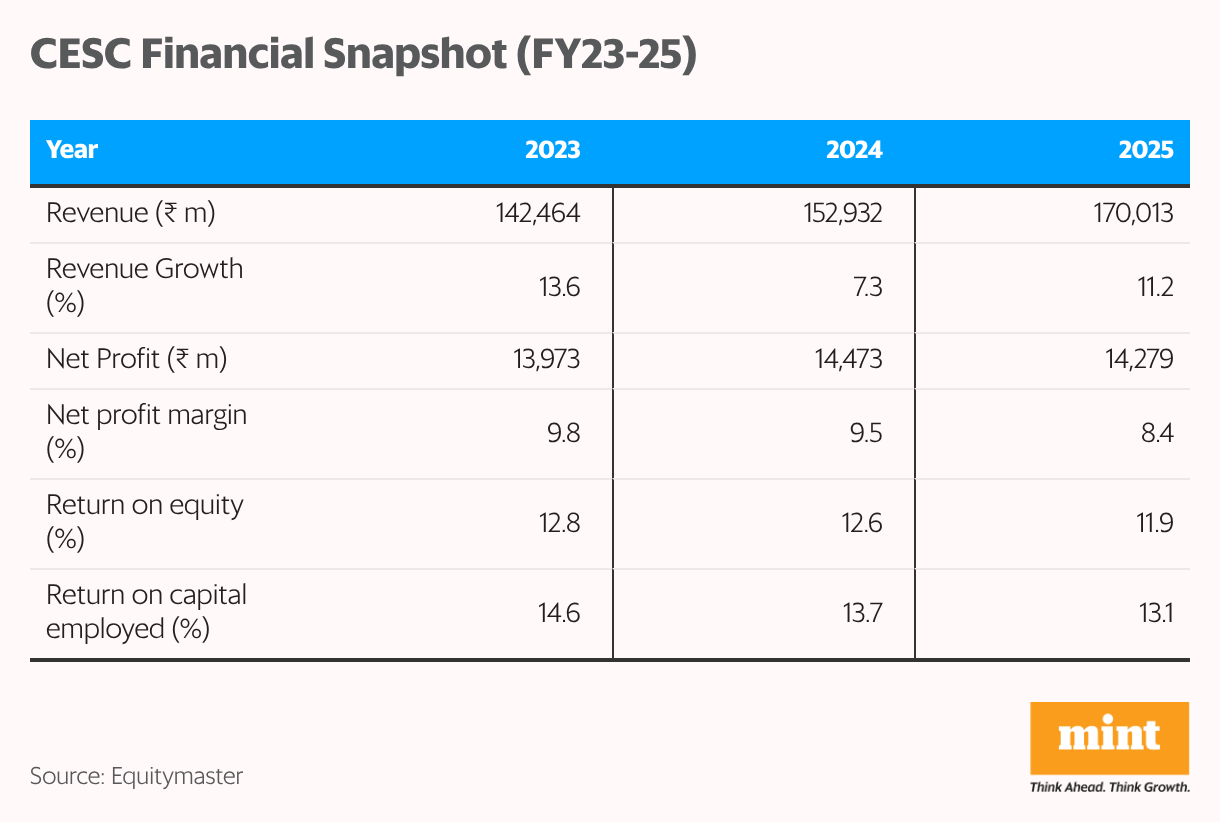

CESC

CESC Ltd, a flagship company of the RP–Sanjiv Goenka Group, is one of India’s oldest integrated power utilities. The company plays a central role in electricity generation, transmission and distribution, with a particularly strong footprint in eastern India.

In West Bengal, CESC holds an exclusive position as the sole electricity distributor within its licensed area, covering Kolkata, Howrah and adjoining regions. Its business remains largely distribution-led, serving several million consumers across its operating geography.

As the Electricity Amendment Bill seeks to introduce competition and parallel distribution, CESC’s licensed monopoly model could come under closer scrutiny. Any regulatory shifts related to tariffs, wheeling charges or licensing norms would have a direct impact on its core operations.

While revenue growth has been modest compared with peers, the company has maintained strong profitability and healthy returns. Management has indicated a continued focus on improving operational efficiency and energy efficiency across its network.

The bigger picture

India has unveiled a comprehensive plan to significantly strengthen its power infrastructure in order to meet a sharp rise in electricity demand over the coming decade. Led by the Ministry of Power, the initiative focuses on expanding and modernising the national grid to improve reliability, efficiency and energy security.

This broader push is expected to support long-term growth for transmission and distribution companies. However, the extent and timing of the benefits will depend on execution, regulatory clarity and cooperation from state governments.

As always, investors should assess company fundamentals, governance standards and valuations carefully before making investment decisions.

Disclaimer: This article is for information purposes only and does not constitute a stock recommendation. This content is syndicated from Equitymaster.com.