So, who is driving this shift? Public shareholders backed largely by institutional investors such as mutual funds, foreign portfolio investors (FPIs) and individuals are steadily increasing their ownership in listed companies.

A Mint analysis of shareholding data from the Centre for Monitoring Indian Economy (CMIE), covering 4,673 listed companies, showed that public shareholding climbed to 48.93% by Q3FY26 from 48.65% in the previous quarter. This marked one of the highest levels of non-promoter ownership in recent years. Their shareholdings had touched a record high of 49.2% in June 2017.

This surge has narrowed the gap between the promoter and public shareholdings to just 92 basis points (bps) — the thinnest margin in 28 quarters, signaling a structural transition toward a more diversified, market-driven ownership model. Data collated since 2011 showed this gap was at its lowest in June 2017, at 13 bps.

Waning dominance of promoters

Promoter shareholding has slipped to 49.85%, falling below the 50% level long associated with majority control. The decline has been gradual but consistent, driven by stake dilution, fundraising, and partial exits as valuations have risen. While promoters still remain the single largest shareholder group, their grip is clearly loosening.

Akhilesh Prakhya, investment manager at SKG Investment & Advisor said, “Promoter holdings have declined steadily from 57.5% in 2009 to around 50% today, driven by promoters reducing portfolio concentration as valuations rise and increasing institutional appetite.”

Vinit Bolinjkar, head of research at Ventura, added that the scarcity premium is fading as promoter ownership slips below 50%. “Prices are now driven by broad-based institutional flows and fundamentals, making markets more democratic and less hostage to insider actions,” he said.

Collective might

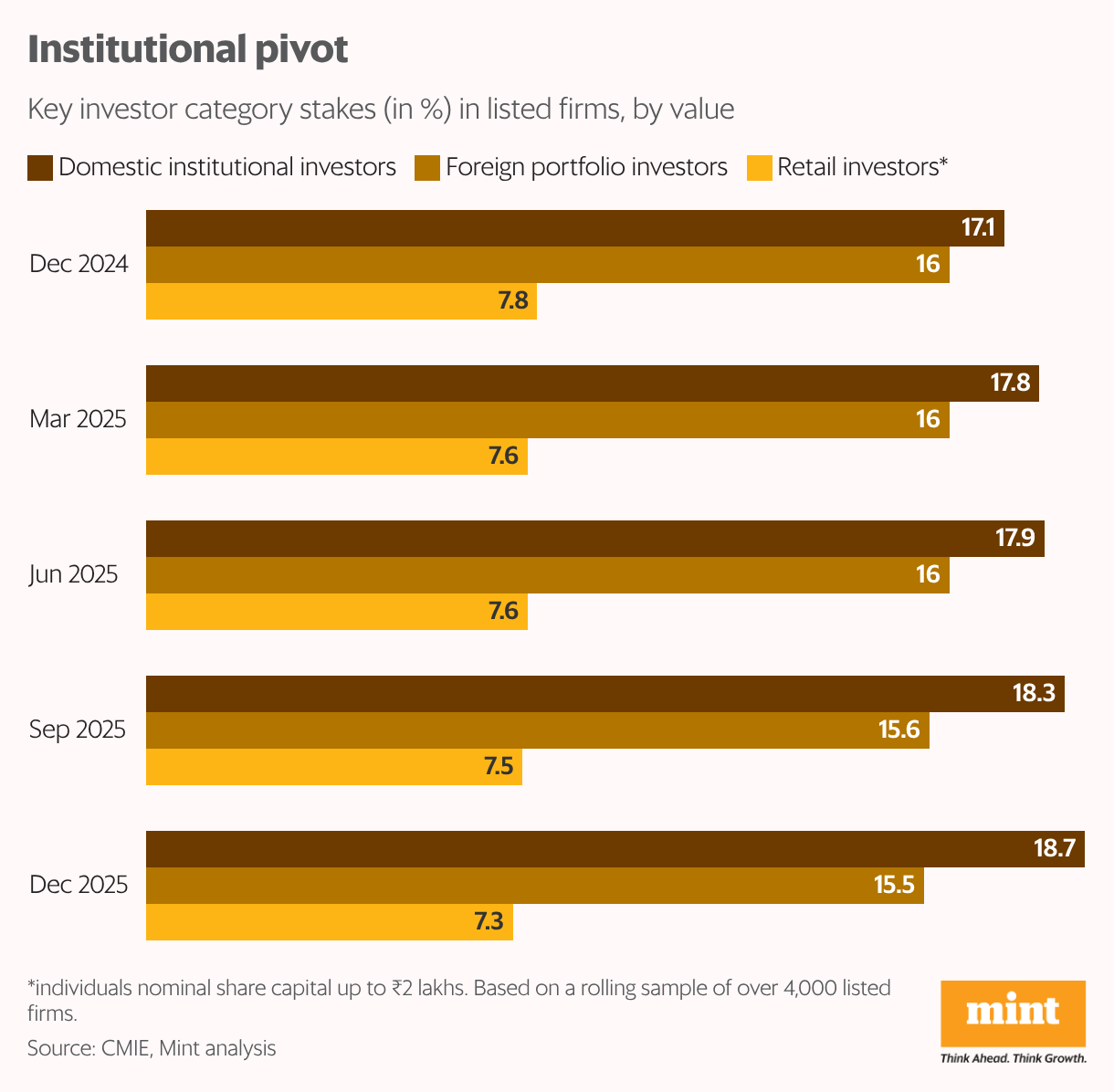

The rise in public ownership is being powered mainly by institutions. Institutional investors’ shareholding rose to a record 34.21% in Q3FY26, up from 33.88% in the previous quarter. Within this, mutual fund holdings also touched a new high, increasing to 10.99% from 10.79%. This shows most household savings that flow into equity markets do so through SIPs in mutual rather than direct stocks.

“The SIP buffer acts as a shock absorber—DIIs (domestic institutional investors) step in during global selloffs, reducing volatility and preventing deep, panic-driven crashes,” said Bolinjkar. He said India was shifting from a founder-led market to a fund-manager-driven one, but warned that this liquidity-based support could weaken if job growth slowed or household stress rose, causing SIP flows into mutual funds to falter.

Gaurav Bhandari, CEO of Monarch Networth Capital, said stronger institutional participation improves market depth, stability and governance standards. “At the same time, higher institutional participation can lead to sharper stock price reactions during corrections, especially where ownership is crowded. Corrections may be faster, but they are also likely to be more orderly and valuation driven rather than sentiment driven,” he added.

Meanwhile, the retail-investor frenzy in equities that peaked during covid seems to be waning too, the non-institutional break-up showed. Retail investors, defined as individuals holding shares worth up to ₹2 lakh, continue to account for a relatively small portion of ownership. Their stake fell to 7.33% in Q3FY26 from 7.54% in Q2FY26, a decline of 21 basis points.This suggests that while domestic money is dominating, it is increasingly coming through institutional vehicles such as mutual funds rather than direct stocks.

Foreign portfolio investors lag

Foreign portfolio investors (FPIs), on the other hand, now lag their domestic counterparts. Their value-based holding stood at 15.48% in Q3FY26, the lowest level since 2012. The shift began around June 2024 quarter, when DII ownership strengthened to 16.3% and began rising steadily, while FPI ownership, then at 16.2%, started to trend lower, marking a clear change in the balance of market influence toward domestic money, the data showed.

Yet, the FPI story is more nuanced than headline outflows suggest. On this, Bhandari said, “FPIs may be tactically cautious in the near term, but strategically they continue to view India as a core long term allocation, particularly in sectors aligned with domestic demand, infrastructure, and global supply chain diversification.”

Double-edged sword

According to Prakhya, “This shift enhances liquidity-driven market dynamics, which can be a double-edged sword. Greater free float and institutional participation improve market depth, breadth and overall liquidity, making markets more efficient and less susceptible to concentrated ownership manipulation. Indian markets exhibit high resilience, normalizing quickly after liquidity shocks due to improved market structure.”

However, liquidity driven markets can also amplify volatility during corrections, as institutional flows particularly from mutual funds and DIIs are more sensitive to short-term performance and redemption pressures than sticky promoter holdings, she added.

Bhandari added: “Importantly, this also signals underlying confidence in India’s structural growth story, even as global investors remain cautious due to geopolitical risks, interest rate uncertainty, and trade realignments. The recently concluded US tariff agreement, which brings greater clarity on global trade flows, further strengthens India’s positioning as a reliable manufacturing and investment destination in a fragmented world.”