The IPL 2026 mini-auction in Abu Dhabi on December 16 wasn’t merely a player marketplace; it was a paradigm shift in how franchise cricket values talent. In a single day of frenetic bidding, ten franchises deployed INR 215.45 crore to acquire 77 players from a pool of 359, creating three new IPL records and fundamentally altering the economic landscape of T20 cricket.

Cameron Green’s INR 25.20 crore deal shattered overseas player valuations, while uncapped teenagers Prashant Veer and Kartik Sharma commanded INR 14.20 crore each, eclipsing established internationals and signalling cricketing’s most dramatic generational wealth transfer.

Yet beneath the headline-grabbing mega-deals lies a more nuanced story: one of market inefficiency, strategic divergence, and ruthless prioritisation of potential over proven pedigree. This data-driven analysis dissects the auction’s most significant trends, examining not just who got paid, but why and what it reveals about the future of franchise cricket.

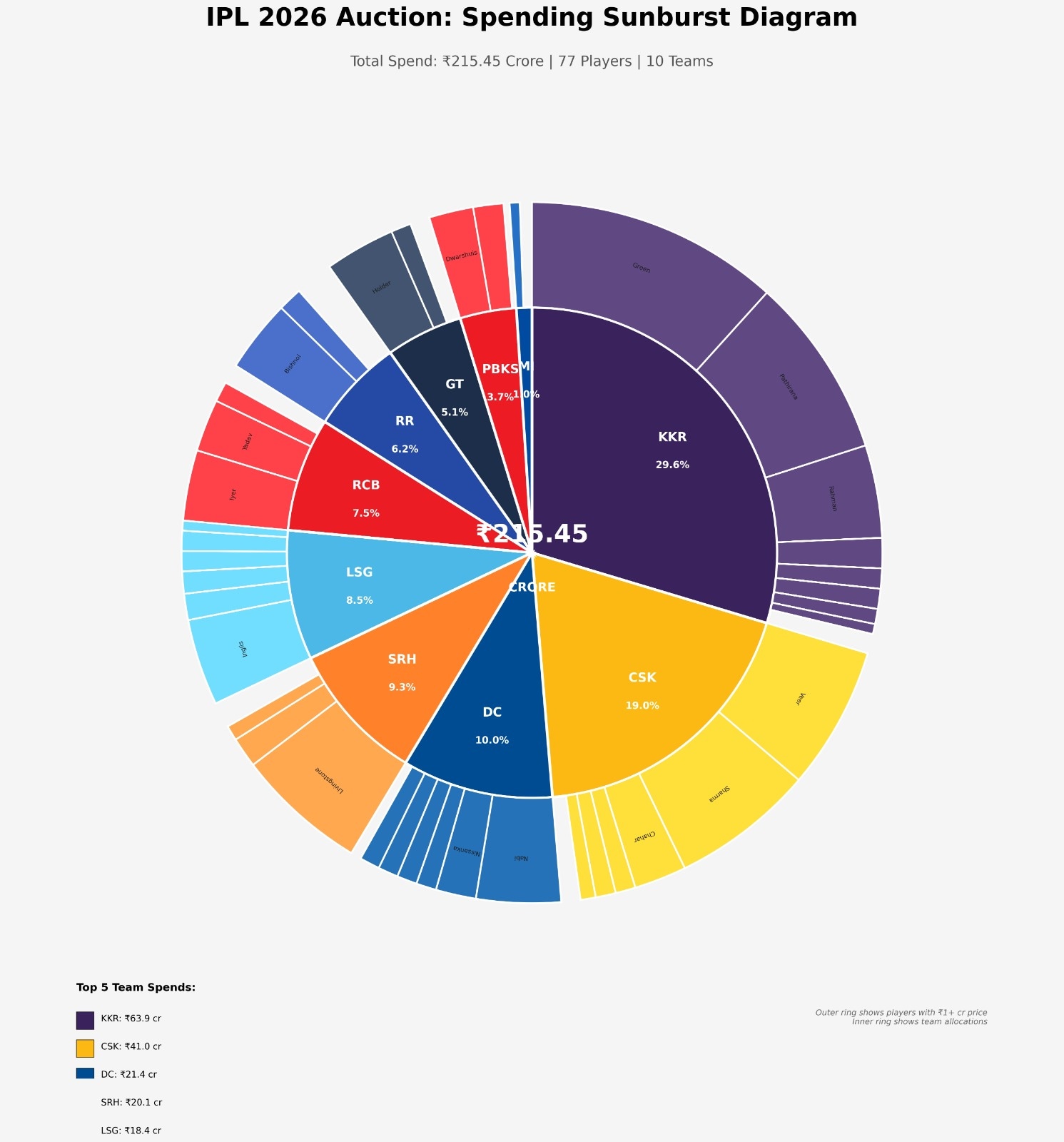

The billion dollar question: Breaking down the INR 215.45 crore spend

The macro picture

The auction demonstrated remarkable restraint despite considerable firepower. With a combined purse of INR 237.55 crore available, franchises deployed just 90.7% of their theoretical spending capacity, leaving INR 22.10 crore unspent across all teams. This conservative approach reflects the mini-auction’s strategic limitations – teams arrived with specific gaps to fill.

The 77 players sold for 156 auctioned (49.4% success rate) underscores a buyer’s market where selectivity trumped volume. More telling, 50 players (64.9% of successful sales) went at base price. The real action concentrated around 27 players, a mere 35% of acquisitions – who triggered genuine bidding wars.

The pending hierarchy: Tale of two strategies

The big spenders:

Kolkata Knight Riders: INR 63.85 crore (13 players, INR 4.91 cr average)

Chennai Super Kings: INR 41.00 crore (9 players, INR 4.56 cr average)

Delhi Capitals: INR 21.45 crore (8 players, INR 2.68 average)

The conservatives:

Mumbai Indians: INR 2.20 crore (5 players, INR 44 lakh average)

Punjab Kings: INR 8 crore (4 players, INR 4 crore average)

Gujarat Titans: INR 10.95 crore (5 players, 2.19 crore average)

This bifurcation reveals fundamentally different squad philosophies. KKR and CSK entered with substantial purses and maximised slots to build depth. In contrast, MI’s miniscule INR 2.75 crore starting purse prompted surgical targeting, their acquisition of Quinton de Kock for INR 1 cr exemplifies value extraction under constraint.

The data suggests a correlation: teams with larger pre-auction purses overspent relative to market value. KKR’s INR 43.40 crore investment in just Cameron Green and Matheesha Pathirana (67.8% of total spend on two players) represents either supreme confidence or spectacular risk concentration.

The uncapped revolutions: Youth trumps experience

Rewriting salary caps

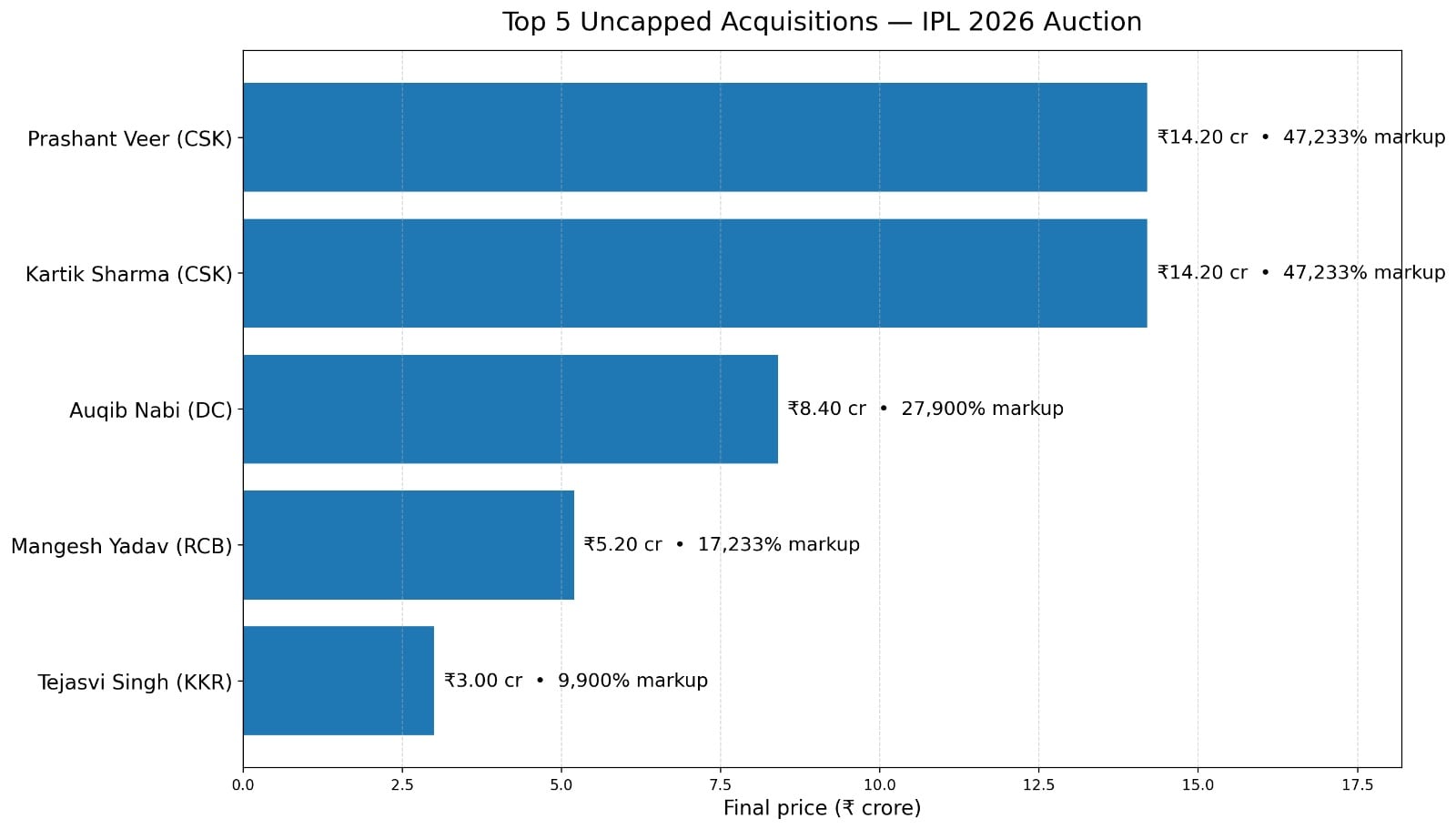

The auction’s defining narrative centers around uncapped Indian players commanding unprecedented valuations. Chennai Super Kings’ dual INR 14.20 crore acquisitions of Prashant Veer and Kartik Sharma obliterated the previous uncapped record of INR 10 crore by 42%.

Top 5 uncapped acquisitionsT

These astronomical markups dwarf even Cameron Green’s 12.6x markup, suggesting franchises perceive greater upside in unproven domestic talent than established international stars.

The economics of potential

The uncapped surge reflects two converging factors:

- Long term asset building: At 19-20 years old, Veer and Sharma theoretically offer 12-15 year careers versus 5-7 for established players approaching 30. CSK’s investment represents amortized value over multiple retention cycles.

- Domestic availability: Unlike overseas stars managing international commitments, uncapped Indians guarantee full tournament availability, a premium in an increasingly congested cricket calendar.

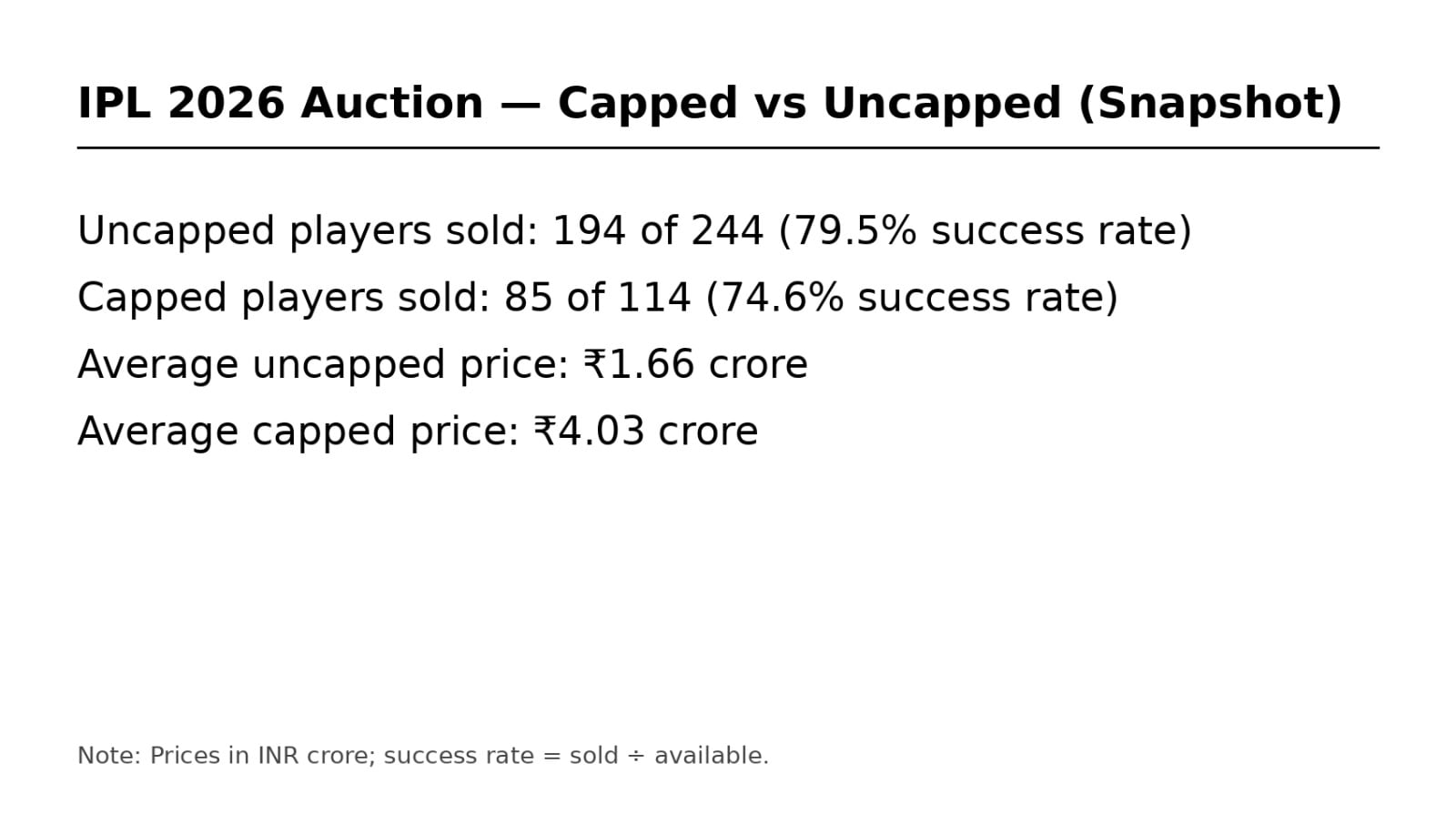

The statistical breakdown reinforces this shit:

Yet the median uncapped price remains INR 30 lakh, creating a barbell distribution where superstars command fortunes while majority earn minimums, identical to global sports labor markets.

The Cameron Green phenomenon: Deconstructing INR 25.20 crore

Record breaking, not precedent-setting

Cameron Green’s acquisition by KKR for INR 25.20 crore eclipsed Mitchell Starc’s INR 24.75 crore (IPL 2024, also KKR) to become the most expensive overseas player in IPL history. Yet the 1.8% premium over Starc hardly constitutes revolutionary spending.

The real story lies in bidding psychology. CSK and KKR engaged in a protracted war that pushed the price, 1,160% beyond Green’s INR 2 crore base price, the auction’s second highest markup percentage. This suggests both franchises perceived Green as irreplaceable rather than merely premium.

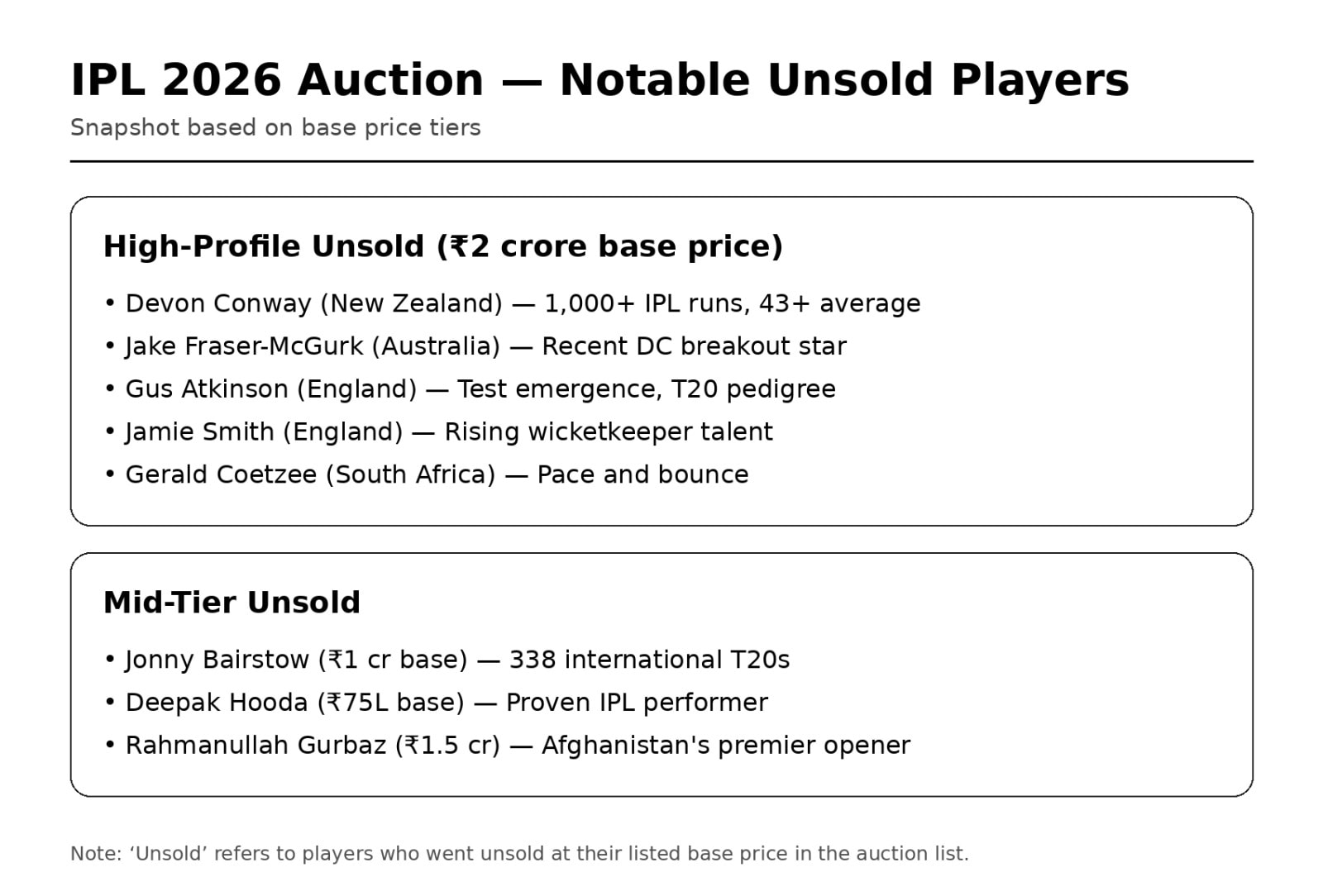

The Unsold Elite: When reputation fails

Market misfires

Perhaps the auction’s most striking feature was the roster of proven internationals who attracted zero bids:

These failures expose franchise cricket’s ruthless meritocracy. Conway’s elegant accumulation no longer fits T20’s hyper-aggressive era. Fraser-McGurk’s explosive cameos couldn’t overcome concerns about technical deficiencies against quality spin. Bairstow’s age trumped his resume.

The age penalty

Statistical analysis reveals a brutal age cliff:

- Players 30+ sold: 22 off 45 (48.9% success rate)

- Players under 25 sold: 47 of 58 (81% success rate)

- Average price, 30+: INR 2.10 crore

- Average price, under 25: INR 2.85 crore

The message is clear: franchises value runway over results. A 23-year-old averaging 35 at 145 SR commands higher premiums than a 32-year-old averaging 35 at 150 SR, even with inferior credentials.

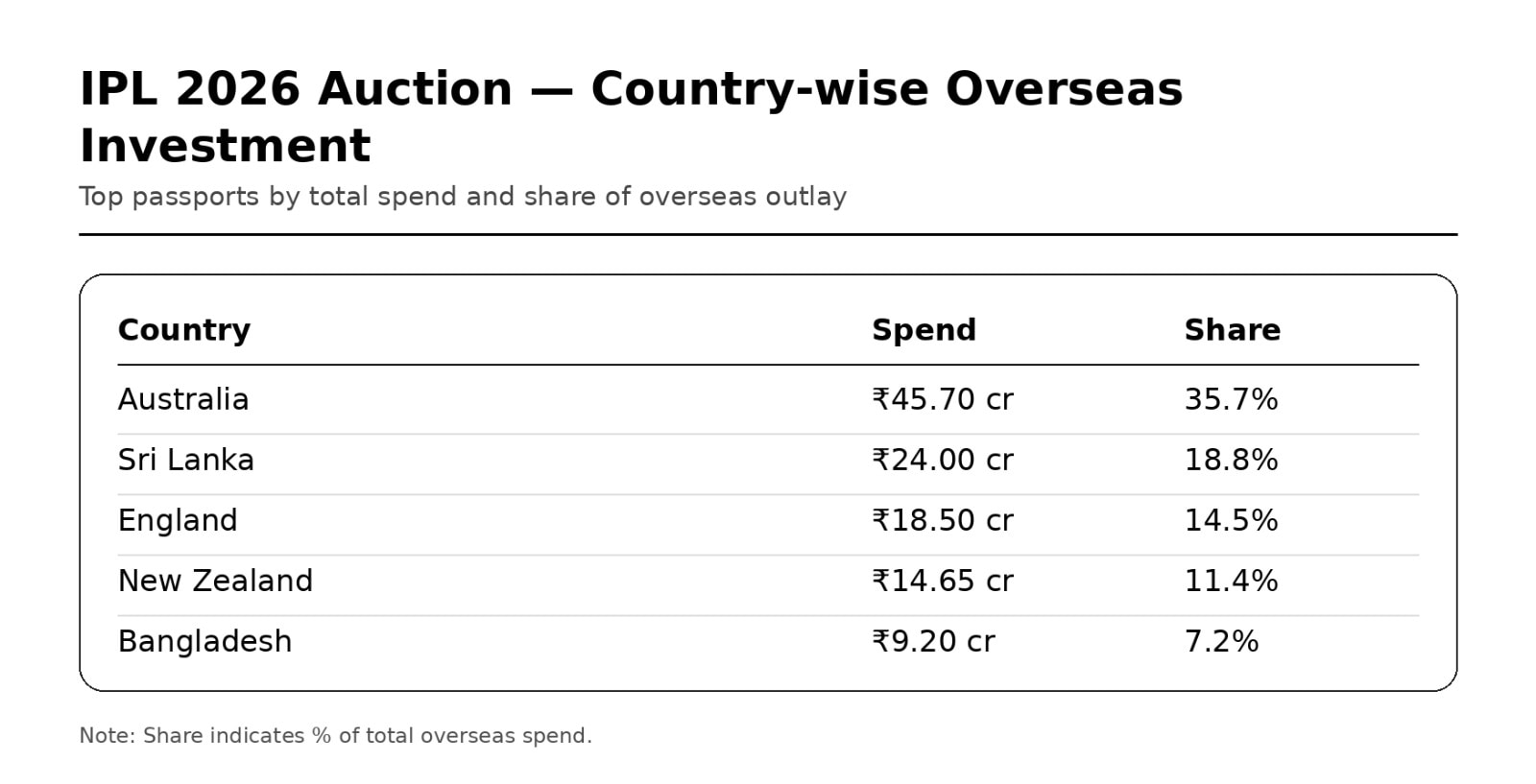

Overseas dynamics: INR 128 Crore conundrum

Despite representing just 24% of the player pool, overseas acquisitions consumed 59.4% of total spending. This 2.4x spend concentration relative to population share underscores the premium franchises place on the international market.

Australia’s dominance reflects their cricket system’s T20 optimization. Big Bash League experience, athletic fielding standards, and power hitting culture translate directly to IPL success. Conversely, New Zealand’s players at INR 1.83 crore average suggests they’re viewed as reliable value picks rather than franchise cornerstones.

The Bangladesh wildcard

Mustafizur Rahman’s INR 9.20 crore deal merits examination. His performance in IPL justify premium pricing, yet potential availability issues with injury and BCB commitments create uncertainty. KKR’s willingness to invest suggests death bowling scarcity outweighs risk calculus.

Overseas efficiency metrics

When analysed through cost-per-slot efficiency:

Most efficient: South Africa (INR 1.75 crore)

Least Efficient: Sri Lanka (INR 8 cr)

This data suggests overpay for specialist skillsets, while bargain-hunting for utility options.

Strategic Divergence: Five different auction philosophies

1. Kolkata Knight Riders

Strategy: Aggressive star acquisition backed by budget depth picks.

Execution:

- Anchor investments: Green, Pathirana

- INR 52.60 crore on three players (82.4%) of spend)

- Remaining ten players at INR 1.125 crore average

Risk Profile: High, KKR is banking on three premium performers elevating a supporting cast acquired at minimums. If injuries derail Green or Pathirana, the squad lacks Plan B depth.

Historical precedent: Similar to their IPL 2024 championship run built around Starc, though current approach concentrates risk further.

2. Chennai Super Kings

Strategy: Invest in uncapped Indians

Execution

- Record uncapped investments: Veer + Sharma (INR 28.40 crore combined)

- Four uncapped players among nine purchases

- Overseas balance: Matt Henry, Akeal Hosein, Mathew Short (INR 6.25 cr combined)

Risk Profile: Moderate-high, CSK is essentially drafting Jadeja’s successor and future wicketkeeping core while maintaining veteran stability.

Strategic Logic: With an aging core, CSK is front-loading next-cycle investments while current leadership can mentor.

3. Sunrisers Hyderabad

Strategy: Maximise roster depth with INR 25.50 crore

Execution:

- 10 players for INR 20.05 crore (INR 2.01 cr average)

- 80% uncapped (8 of 10)

- Single marquee: Liam Livingstone (INR 13 cr)

Risk Profile: Low-moderate. Diversified portfolio minimises individual dependency, though lacks star power to close tight matches.

Tactical implications: SRH is building bench strength for tournament rotation, smart given IPL’s condensed windows and workload management needs.

4. Mumbai Indians

Strategy: Surgical gap-filling within budget

Execution:

- INR 2.20 crore total spend (lowest in auction)

- Five players bought, four at base price

- Quinton de Kock value grab

Risk Profile: Extremely low. MI’s retained core left minimal auction needs.

Strategic Insight: Teams with strong retention treat auctions as afterthoughts. MI’s approach validates retention-first squad building.

5. Delhi Capitals

Strategy: Load overs slots, fill Indian depth at base prices

Execution:

- Five overseas players of eight total (62.5%)

- INR 21.45 crore spend heavily weighted toward internationals

- Auqib Nabi exception

Risk Profile: Moderate. DC’s overseas-heavy auction approach maximises per-game quality but creates conflict risks.

Philosophical question: Is DC building for regular season dominance or playoff resilience?

Market Efficiency Analysis: The 64.9% Paradox

Base Price Dominance

The auction’s most revealing statistic: 50 of 77 players (64.9%) sold at base price with zero bidding competition. This suggests:

- Information Asymmetry: Most players lack differentiated scouting profiles, reducing perceived value variance.

- Roster Completion Pressure: Teams filling final slots default to base prices rather than compete for marginal upgrades.

- Talent Surplus: Supply exceeds demand except for elite/specialist skills.

Bidding War Analysis

The 27 players who triggered competitive bidding (35.1% of sales) consumed INR 177.65 crore—82.5% of total auction spend. This concentration mirrors wealth inequality in broader economies: winner-take-all markets where superstars capture disproportionate value.

Each bid represents a INR 20 lakh increment (minimum), meaning Green’s 117 bids spanned INR 23.4 crore in bidding range—a testament to polarized valuations between KKR and CSK.

Auction Velocity Insights

The mini-auction format (single-day, ~6 hours) created compression effects:

- Early Sets (1-3): Conservative, low sell-through (only Green + Miller from Set 1)

- Mid-Auction (Sets 4-7): Peak activity as teams establish baselines

- Accelerated Rounds: Bargain hunting, unsold recirculation, squad completion