Simon Jack,BBC Business Editorand

Lucy Hooker,Business reporter

Getty Images

Getty ImagesA climbdown on forthcoming increases to the business rates bills faced by pubs in England is set to be announced by the government in the next few days.

The government is expected to say it will make changes to how pubs’ business rates are calculated, resulting in smaller rises to bills.

Treasury officials say they have recognised the financial difficulties facing many pubs after sharp rises in the rateable value of their premises.

The move follows pressure from landlords and industry groups that included more than 1,000 pubs banning Labour MPs from their premises.

The BBC understands it will apply only to pubs and not the whole hospitality sector.

The Treasury is also thought to be ready to relax licensing rules to allow longer opening and more pavement areas for drinking.

In her November Budget, Chancellor Rachel Reeves scaled back business rate discounts that have been in force since the pandemic from 75% to 40% – and announced that there would be no discount at all from April.

That, combined with big upward adjustments to rateable values of pub premises, left landlords with the prospect of much higher rates bills.

A campaign to dilute the impact of these rises has been gaining traction in recent weeks, with pub owners and industry groups lobbying for more support.

Conversations between the government and the hospitality sector were “ongoing”, DWP minister Dame Diana Johnson said.

Speaking to Radio 4’s PM programme, she said: “We as a government want to make business rates fairer but you’ll also know we’re coming to the end of the transitional relief that was available because of Covid.”

On Wednesday Labour MPs called on the government to rethink its support for the industry.

Conservative leader Kemi Badenoch said: “What has happened is that over Christmas Labour MPs were banned from every single pub they tried to get into… so now they are pushing for a U-turn.”

She said the Conservatives had a “much better plan” which was to “slash business rates for all of the High Street, not just pubs”. She said business rates bills of less than £110,000 would be scrapped completely.

Reform also welcomed the climbdown, saying “pubs have already been lumbered with astronomical energy costs”.

The party’s deputy leader Richard Tice said: “Pubs are the backbone of our communities and a huge part of British heritage. Their closures would be a cultural catastrophe as much as an economic one.”

To calculate a pub’s business rate bill the rateable value of its premises is multiplied by a set figure: “the multiplier”.

The government had already offered some relief by reducing the multiplier for pubs, and may be about to reduce it further.

Alternatively they could boost the £4.3bn “transitional relief” fund brought in to ease the impact of withdrawing support following the pandemic.

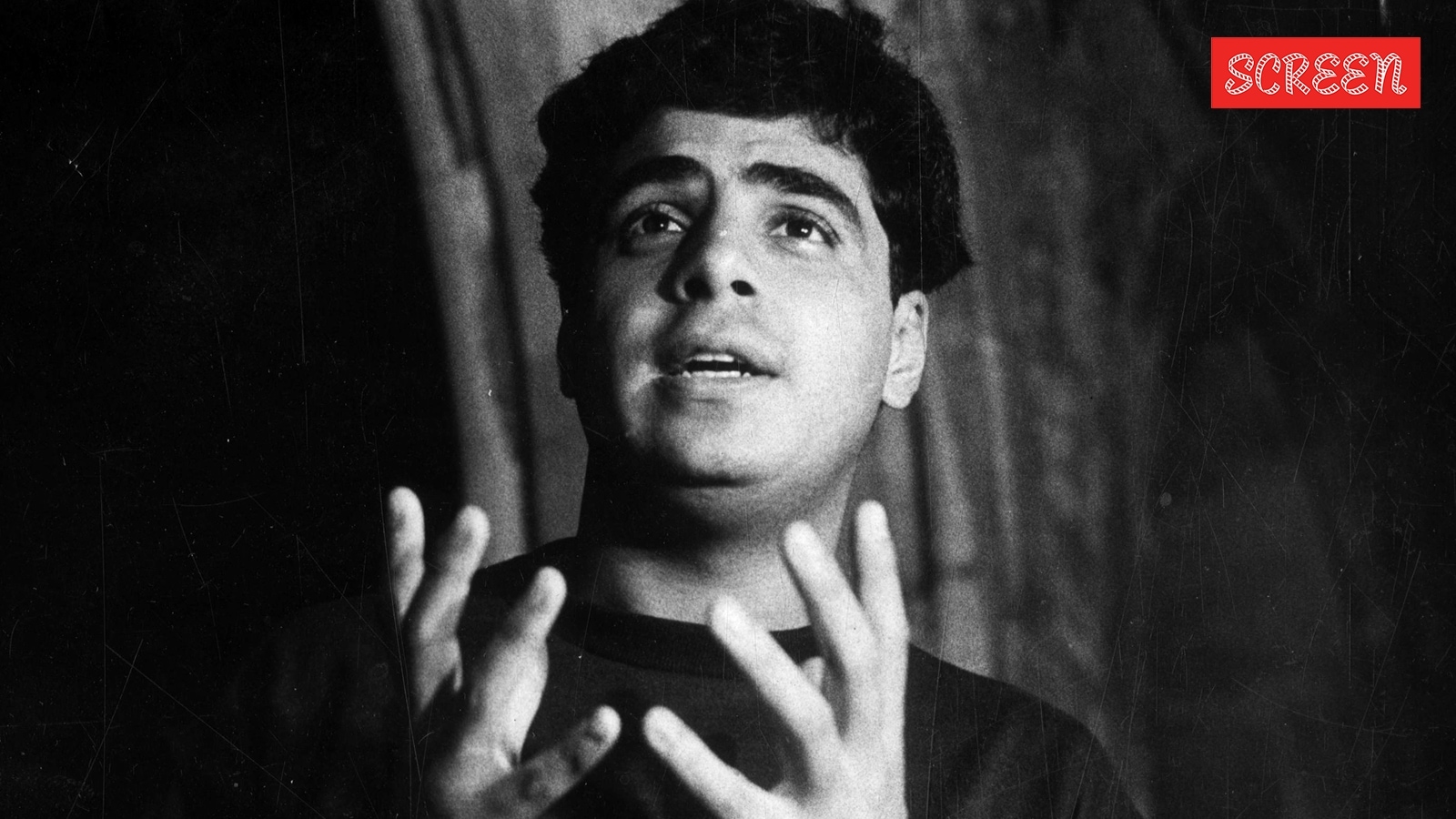

Geoff Robbins

Geoff RobbinsGeoff Robbins, who owns the Wheatsheaf Pub in Faringdon, Oxfordshire with his wife Jo, said it was “a great relief” that more help was on the way.

His rates are due to rise by around 80% over the next three years. He needs a discount on most of that, he reckons, after factoring in higher gas, electricity and staffing costs.

“Rates are a tax against your business whether you make a profit or loss… you’ve got to pay, there’s no way round it,” said Geoff, who got in touch with BBC Your Voice.

Industry groups also welcomed news there would be additional help.

Emma McClarkin, chief executive of the British Beer and Pub Association, said it was “potentially a huge win” for the sector.

“This could save locals, jobs, and means publicans can breathe a huge sigh of relief,” she said.

Kate Nicholls, chair of UK Hospitality, representing the industry, said the support should apply not just to pubs, but to all hospitality businesses affected by rising rates, including cafés and restaurants.

“We need a hospitality-wide solution, which is why the government should implement the maximum possible 20p discount to the multiplier for all hospitality properties,” she said.

Other sectors are calling for the support to be even broader, to include live music venues, theatres, galleries, gyms and retailers.

Unpicking the recent Budget would be seen by many as another U-turn following climbdowns on winter fuel payments, disability benefits and inheritance tax on farms and family businesses.

Shadow business and trade secretary Andrew Griffith said the change showed Rachel Reeves’ Budget was “falling apart”.

“Labour were wrong to attack pubs and now have been forced into another screeching U-turn,” he said.

Liberal Democrat Treasury spokesperson Daisy Cooper said: “This is literally the last chance saloon for our treasured pubs and high streets – so the government must U-turn, today.

“These businesses are worried sick, making decisions now, and can’t wait a minute longer.”

The calculation of business rates is an issue that is devolved in all four UK nations.

The discount on rates during the pandemic only applied to hospitality businesses in England.

Scottish businesses are waiting for the Budget there next week to hear how the Edinburgh government will approach the issue.

Pubs there will hope the Scottish government follows the UK government in offering some relief.

Additional reporting by Kris Bramwell