Leonardo Maria del Vecchio attends the amfAR Gala Venezia 2023 presented by Mastercard and Red Sea International Film Festival on September 03, 2023 in Venice, Italy.

Kristy Sparow | Getty Images Entertainment | Getty Images

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

Wall Street advisors were kept busy in December — from the Warner Bros. Discovery bidding war to Trump Media’s $6 billion merger with a nuclear fusion company. However, private investment firms of ultra-rich families were in no rush to ink deals before the year-end.

In December, family offices made 35 direct investments in companies, down about 62% on an annual basis, according to data provided exclusively to CNBC by private wealth platform Fintrx. The results capped off a subdued year for family office dealmaking, as firms dialed back their direct bets in light of tariff uncertainty and geopolitical conflict.

Even so, millennial and Gen X heirs are continuing to make their mark through their family offices.

Motier Ventures, one of the most active family offices per Fintrx’s data, was founded by Guillaume Houzé, the 44-year-old, fifth-generation heir to French department store chain Galeries Lafayette. The French firm, known for its tech-heavy portfolio, joined a 7.2 million euro ($8.5 million) seed round for blood testing startup Lucis in December.

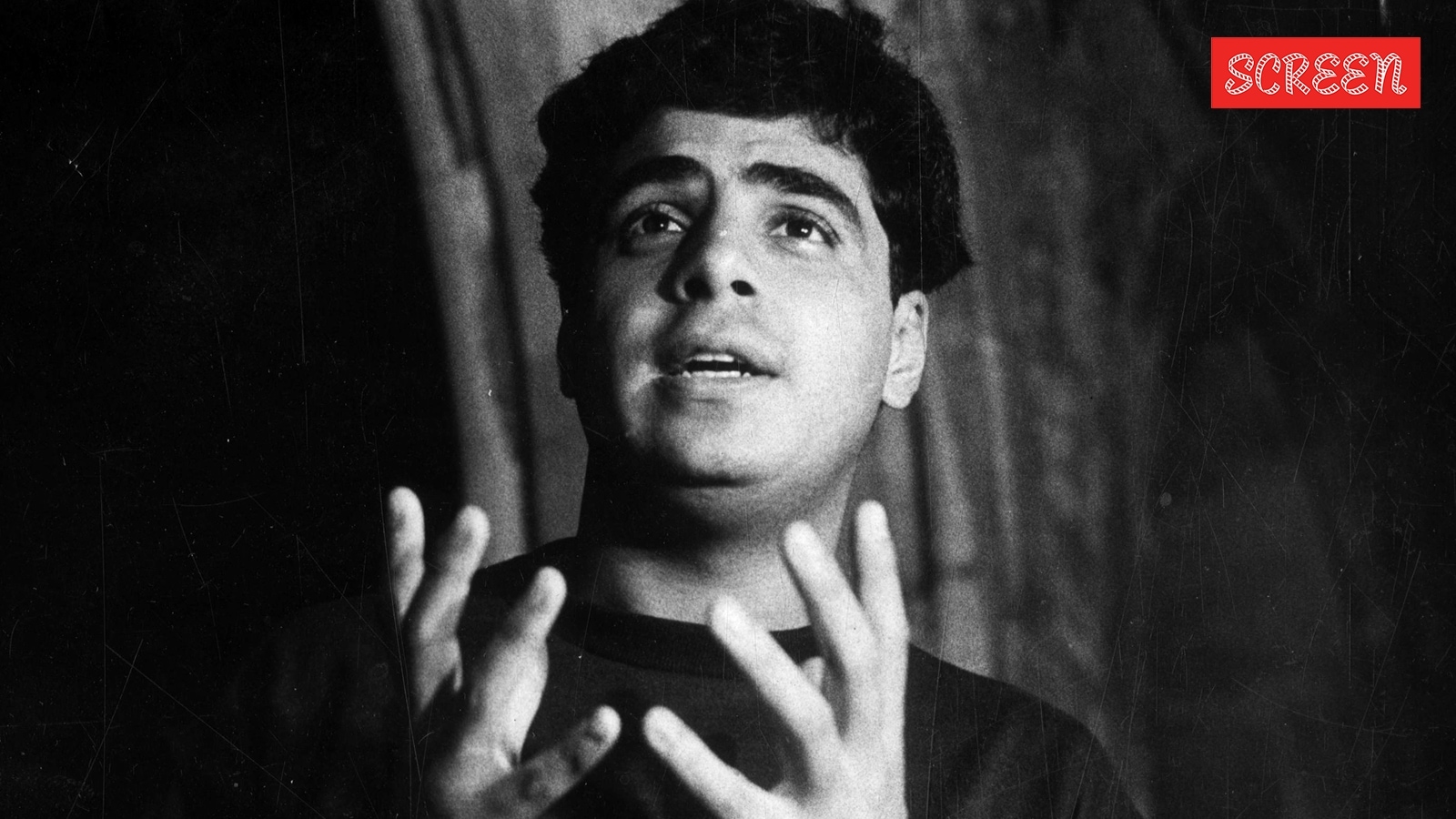

Next-gen heirs frequently invest outside the industries that created their family fortunes. Last month billionaire eyewear heir Leonardo Maria Del Vecchio acquired 30% of Italian right-wing news outlet Il Giornale through the newly established media division of his family office, LMDV Capital. Del Vecchio, whose late father founded Luxottica, said in an interview with Italian press that he doesn’t expect large returns and is investing out of a sense of civic responsibility.

“My desire is to build an Italian information hub, untied by the colors of politics. No left or right, for the future of our children and of Italy,” the 30-year-old told The Economyaccording to a CNBC translation. “Publishing needs a new force, also to re-establish the connection with young people who are looking for information but in the wrong places. I would like these young people to go back to turning the pages of print newspapers and magazine and getting their hands dirty with ink.”

Ultra-high-net-worth families have traditionally used philanthropy as a means to bring the next generation into the fold, and it’s still a popular route. However, families are increasingly using direct investing — often with a sustainability bent — to engage heirs, according to Scott Saslow, a family office consultant and principal.

“Those families have found interesting ways to engage the next gen by saying, ‘Hey, you know, this isn’t about having a nice house or driving a nice car. This is about being able to do something pretty impactful in the world with this capital from this place of privilege,'” he said.

According to UBS’ most recent family office survey, just under a third of family offices said they expected next-generation family members to be involved in direct investments, and 39% said they expected the next gen to help manage investments.

— CNBC’s Gaelle Legrand contributed to this report.