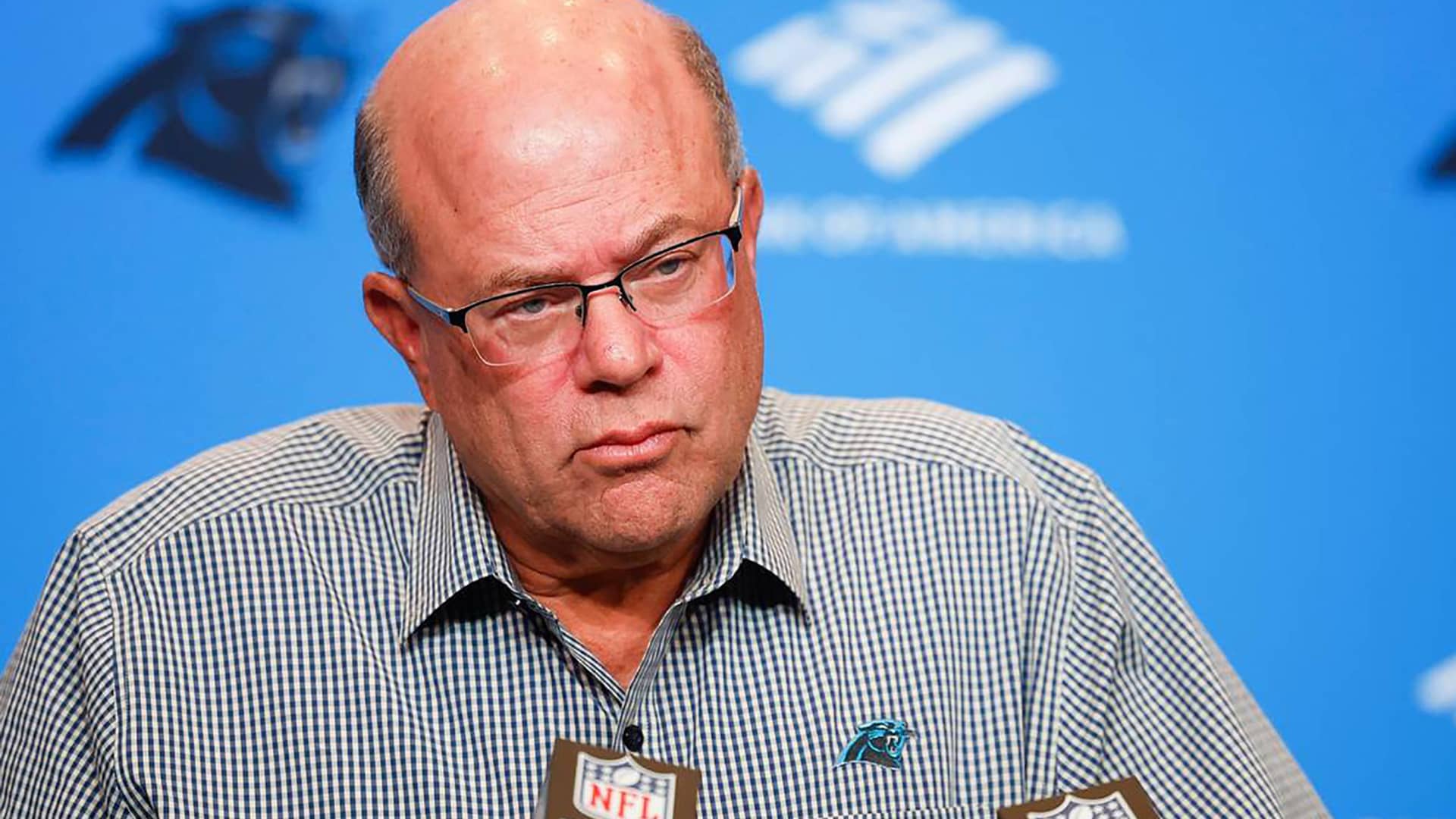

Carolina Panthers owner David Tepper listens to a question during a press conference in 2022.

Alex Slitz | Tribune News Service | Getty Images

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

Private investment firms of the ultra-wealthy bought beaten up stocks last quarter as AI enthusiasm boosted global markets to record highs, according to third-quarter securities filings analyzed by CNBC.

Hedge-fund billionaire David Tepper’s family office Appaloosa exited its entire stake in Oracle in the three months ended Sept. 30. During that period, shares of the software giant rallied by nearly 29%. Last quarter, Appaloosa locked in gains for “Magnificent Seven” stocks by closing its stake in Intel and trimming its Meta holdings by 8%.

Meanwhile, Appaloosa doubled down on tariff-beaten consumer stocks, increasing its stake in Whirlpool by 2,000%. Appaloosa’s 5.5 million shares in the home appliance company ranked as its third-largest holding at the quarter-end, worth $432 million. In the second half of the year, Whirlpool stock fallen by almost 31% thus far. Tepper’s firm also upped its stake in Goodyear Tire & Rubberwhich is down 13% this year.

Carl Icahn’s namesake family office is also betting on a turnaround for a consumer stock, increasing its holdings of International Flavors & Fragrances by 27% to $292 million. IFF, which is down 23% for the year, produces ingredients for a wide array of consumer products from potato chips to deodorant. Icahn, a longtime activist investor, first built his IFF stake in 2022, and his son Brett joined the firm’s board in late October per a prior agreement between IFF and Icahn Capital.

Omega Advisors, Leon Cooperman’s hedge-fund-turned-family-office, leaned into health insurance stocks, increasing its Cigna stake by 53% to 325,000 shares. Cooperman’s firm also widened its position in Elevance Health by 21%, making it Omega Advisor’s eighth-largest holding with a quarter-end value of $110.2 million. Shares of Cigna and Elevance are both down about 18% for the second half of the year, pressured by rising medical costs and anticipated government cuts to healthcare funding.

These bold bets aside, family offices are still buying the rally of some Mag 7 stocks. Soros Fund Management increased its stakes in Apple and Amazon by 2,000% and 481%, respectively. Amazon shares make up the firm’s largest holding with a quarter-end value of $489 million.

Stanley Druckenmiller’s Duquesne Family Office initiated positions in Amazon and Meta of $96 million and $56 million, respectively, after exiting them in the prior quarter.

Even Appaloosa, having whittled down its positions in several tech giants, upped its Nvidia holdings by 9%.